|

Ownership

|

70% IAG |

Location |

Ontario, Canada |

|

Status

|

In Production |

Commodity |

Gold |

|

Mining

|

Open Pit |

Processing |

HPGR, CIP |

|

LOM

|

2041+ |

|

|

|

Reserves

|

7.3 Moz |

M&I Resources

Inf. Resources |

16.2 Moz

4.2 Moz |

M&I resources are inclusive of mineral resources

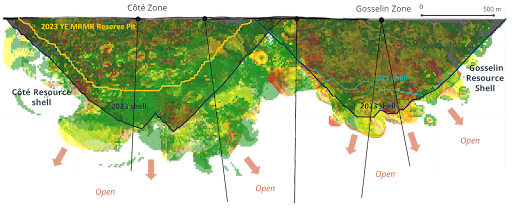

The Côté Gold Mine, located in northeastern Ontario, is a large-scale open-pit gold mining operation jointly owned by IAMGOLD (70%) and Sumitomo Metal Mining Co. Ltd. (30%). The mine officially achieved commercial production in August 2024, following its first gold pour in March 2024, and has achieved its nameplate processing capacity of 36,000 tonnes per day. Designed with cutting-edge technology, the site features autonomous haul trucks and drills. The Côté Gold Mine has significant growth potential, as IAMGOLD works to bring the large Gosselin zone into an updated mine plan that targets both the Côté and Gosselin pits at an increased throughput rate – positioning Côté among the largest gold mines in Canada.

Beyond its operational scale, the mine is a major economic driver in Ontario, contributing an estimated $5 billion in wages and economic activity. It supports over 600 full-time jobs and maintains strong partnerships with local Indigenous communities, including Mattagami First Nation and Flying Post First Nation. The project also emphasizes sustainability and innovation, integrating environmental stewardship and digital technologies to enhance safety and efficiency throughout its operations.

Operations

|

|

|

|

Key Operating Statistics (100% basis, unless otherwise stated)

|

2024 |

|

Ore mined (000s t)

|

10,849 |

|

Grade mined (g/t)

|

0.97 |

|

Operating waste mined (000s t)

|

16,666 |

|

Material mined (000s t) - total

|

39,336 |

|

Strip ratio

|

2.6 |

|

Ore milled (000s t)

|

4,948 |

|

Head grade (g/t)

|

1.37 |

|

Recovery (%)

|

92 |

|

Gold production (000s oz) - 100%

|

199 |

|

Gold production (000s oz) - atrributable

|

124 |

|

Cash costs ($/oz sold)

|

1,032 |

|

AISC ($/oz sold)

|

1,658 |

Reserves and Resources

|

Tonnes

(000s) |

Grade

(g/t) |

Ounces

(000s) |

|

Côté Gold Deposit

|

|

|

|

P&P Reserves

M&I Resources (incl.)1

Inferred |

229,175

438,544

60,362 |

1.00

0.84

0.61 |

7,341

11,785

1,177 |

|

Gosselin Deposit

|

|

|

|

Indicated

Inferred |

161,300

123,900 |

0.85

0.75 |

4,420

2,980 |

|

Côté Gold - Total

|

|

|

|

P&P Reserves

M&I Resources (incl.)1

Inferred |

229,175

599,844

184,262 |

1.00

0.84

0.70 |

7,341

16,205

4,157 |

* M&I resources are inclusive of mineral reserves

Location

Côté Gold is located in the Chester and Yeo Townships, District of Sudbury, in northeastern Ontario. It is approximately 25 km southwest of Gogama, 125 km southwest of Timmins, and 175 km northwest of Sudbury. The mine is accessible year round via Highway 144 which runs north-south 5 km to the east. The Côté Gold properties were assembled through staking and option agreements covering a total area of about 596 km2.

Côté Gold is located on Treaty 9 territory, on the traditional lands of Mattagami First Nation and Flying Post First Nation as well as within the traditional harvesting area of the Abitibi Inland Historic Métis Community, Métis Nation of Ontario Region 3.

Geology & Mineralization

The Côté and Gosselin deposits are located in the Swayze greenstone belt in the southwestern extension of the Abitibi greenstone belt of the Superior Province. The greenstone (supracrustal) assemblage is part of the well defined Ridout syncline that separates the Kenogamissi granitoid complex to the north from the Ramsey Algoma granitoid complex to the south.

The Côté and Gosselin deposit type gold mineralization consists of low to moderate grade gold (±copper) mineralization associated with brecciated and altered tonalite and diorite rocks. Several styles of gold mineralization are recognized within the deposit, and include disseminated, breccia hosted and vein type, all of which are co-spatial with biotite (± chlorite), sericite and for the Côté deposit silica-sodic alteration.

Disseminated mineralization in the hydrothermal matrix of the breccia is the most important style of gold (±copper) mineralization. This style consists of disseminated pyrite, chalcopyrite, pyrrhotite, magnetite, gold (often in native form), and molybdenite in the matrix of the breccia and is associated with primary hydrothermal biotite and chlorite after biotite.

The nature of the veins and fractures vary from stockworks to closely-spaced, planar, subparallel sheeted vein sets.

History

Prospecting and exploration activity in the Project area began circa 1900. The first discovery of note was the Lawrence copper prospect on the east shore of Mesomikenda Lake in 1910. Further interest in the area was sparked in 1930 when Alfred Gosselin found outcropping gold mineralization on the east shore of Three Duck Lakes.

Historical work on the Property has been conducted in multiple stages:

- In the early 1940s extensive prospecting and trenching was conducted, in addition to the sinking of several shallow shafts and some minor production.

- Through to the late 1960s little or no work was performed.

- From the early 1970s to approximately 1990, extensive surface work was performed, in addition to some limited underground investigations.

- From 1990 to 2009, fragmented property ownership precluded any major programs.

- In 2009, a group of properties that became the Chester property was consolidated by Trelawney Mining and Exploration Inc.

- The Côté Gold deposit was discovered in 2010

IAMGOLD acquired Trelawney in 2012. Trelawney had carried out exploration activities at the Project site since 2009. Numerous gold showings have since been identified across the property.